Global demand for hydrogen is expected to grow by only about 22% by decade’s end.

Hydrogen production capacity to reach 150 million tonnes by 2030 versus demand of 115 million tonnes

London, 5 December 2022 — Global announcements of hydrogen projects at the current rate could cause the supply of the molecules to exceed demand by 2030 which could drive down investor interest in the sector and place the nascent hydrogen industry’s supply chain at risk, a new Energy Industries Council’s report has warned.

The Hydrogen EIC Insight Report tracks hydrogen projects around the globe, analysing the current state and future developments of the hydrogen industry. The EIC is one of the world’s largest energy trade associations and purveyor of world classes data, analysis, and industry events.

Global demand for hydrogen is expected to grow by only about 22% by the end of this decade. The International Energy Agency forecasts global hydrogen demand to reach 115 million tonnes by 2030 compared to 94 million tonnes in 2021.

But data from EICDataStream—EIC’s proprietary database of more than 12,000 in-development energy projects across the globe—indicate that by 2026 we could be looking at a pipeline of hydrogen production projects which could surpass the projected demand in 2030. Given the current run rate of announcements, by 2030, global hydrogen production could reach 150 million tonnes per annum.

“All the policies that have been announced thus far to stimulate demand are simply not enough,” the report states. “It is imperative to increase clean hydrogen demand now to stimulate its uptake as a clean energy vector. Insufficient demand will quickly lead to clean hydrogen producers not being able to secure off-takers and unlock investment to scale up production. This tipping point, the time when projects no longer have off-takers, is fast-approaching, and could lead to a rapid commodity price reduction for hydrogen but also rapid negative Return on Investments for many of the touted new hydrogen projects.”

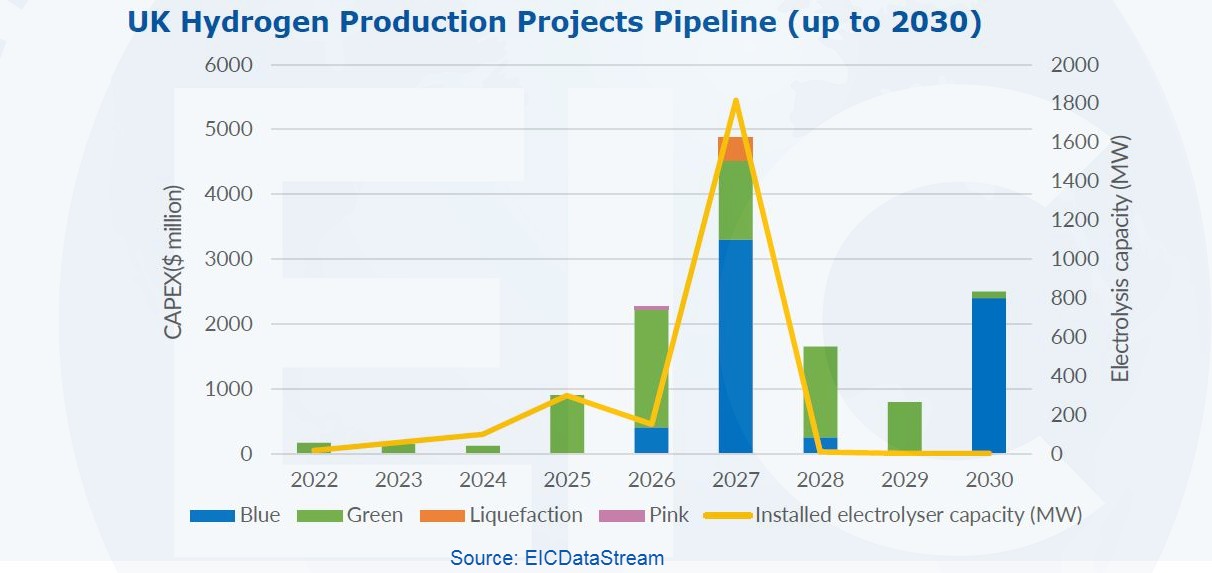

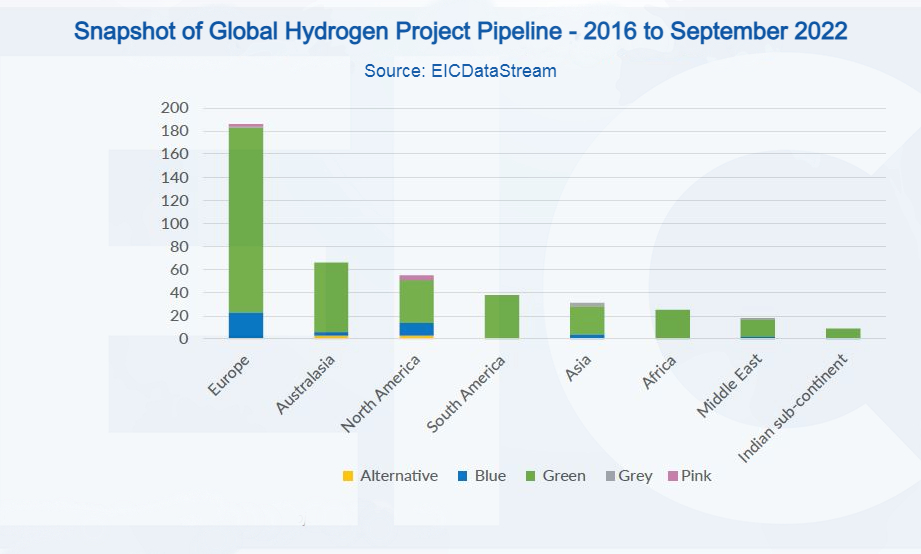

There is a global pipeline of more than 400 hydrogen production projects that are in the planning or development stage with an expected investment of $400 billion to come online by 2030, according to EICDataStream database. Green hydrogen accounts for more than 85% of the projects in the pipeline. As we stand, Europe has the highest number of projects, led by the Netherlands, Germany, and the UK. Projects are also found in Australasia, North America, South America, and Asia.

The report’s author, Dr. Madana Nallappan, EIC Analyst for Asia Pacific Region, said: “EIC data is revealing to us a part of the picture that no one seems to be talking about. The hydrogen industry is so far very production-focused and not enough time and resources are being dedicated to creating the market for the product. The risk is that if you don’t create enough demand, investors are less likely to consider it as a worthwhile investment.”

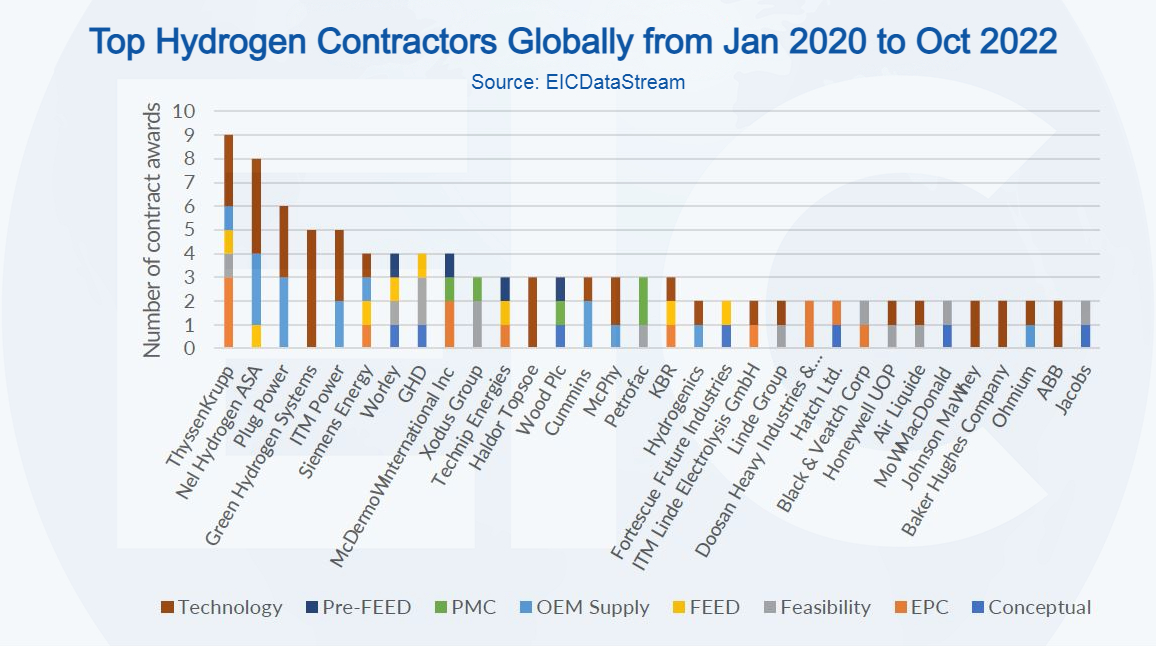

Dr. Nallappan stressed, however, that although the Hydrogen industry is a nascent industry it presents the energy supply chain with opportunities. “Supply chain businesses should start acting now to gain the first-mover advantage,” she said. “It’s time to start identifying opportunities within the hydrogen value chain, be it supplying existing offerings or modifying equipment and services to support the market. Obviously, a lot the equipment needed for the hydrogen sector are already part of other non-hydrogen supply chains such as downstream oil and gas.”

Rebecca Groundwater, EIC’s Head of External Affairs, said: “We have great export potential, not just for UK companies but globally, however we have to also ensure that the demand side is in place to deliver. But if we want to actually see this manifest then we need to nurture the industry and have a credible pipeline of activity that supports both the production and demand sides.”

She added: “Many countries have hydrogen strategies and these need to be looked at together to allow the supply chain to develop and base themselves where the best chance of success is in terms of hydrogen production and marketing. That’s what we are working toward and that’s why we work with stakeholders to ensure that strategies lead to meaningful engagement with the supply chain.”