At the Offshore Energy Exhibition & Conference (OEE2022) this week, one of Europe’s leading conferences for the floating energy industry, with 80 speakers and 9000 visitors, EIC analyst Sharanya Kumaramurthy took part in a panel titled "Focus on Floating Wind", to share EIC data and insight into the sector.

The panel discussion was moderated by Paul de Leeuw, Director RGU Energy Transition Institute, and speakers included Arvid Nesse, Manager at Norwegian Offshore Wind Cluster, Barend Jenje, Commercial Director Floating Wind at GustoMSC, and Joop Roodenburg, President of Huisman.

Sharanya said that while the floating wind industry remains at a nascent stage of development, the EICDataStream—EIC’s proprietary database of more than 12,000 in-development energy projects across the globe— reveals a global interest, with over 140GW to be installed by 2035.

“This figure does not include upcoming leases and future targets, which mean even more unprecedented short-term growth for the industry,” she said. “The UK is currently paving the pathway with the largest operating floating wind farm and the most active pipeline of projects. The UK is also one step ahead of the game, using leases to focus on untapped regions such as the Celtic Sea, system integration through green hydrogen coupling, and decarbonisation of oil and rig platforms via floating wind farms.”

Sharanya added that the rest of the globe is closely following suit, including in the Northern and Mediterranean regions of Europe, and in Asia's Japan, South Korea, and Australia. She added, however, that all eyes are currently on the newest and hottest market entry: California.

The state is holding the USA's first large scale leasing round, housing over 4.5GW. It has attracted 43 potential bidders, including major energy players such as BP, TotalEnergies, and SSE Renewables. Results are to be announced 6 December 2022.

She pointed out, that as promising the data appears, multiple challenges are expected to arise. “The speed and scale needed in the next few years will impact the whole supply chain. Radical change will be needed in installation, which larger vessels for increasing turbine sizes but also a larger quantity for the projects in the pipeline, and more innovative ways to speed up the process of installation.”

“No country at present is equipped with the infrastructure and space to build these wind farms,” she said. “Costs are already expected to plummet to similar prices at fixed bottom turbines by the end of the decade, and countries need to think fast on how the industry will financially support both energy customers and the industry. Turbine and OEM providers are already amidst economic struggles, and we are seeing this trickle down the supply chain to the smaller companies.”

She went on to explain that: “While we are seeing the aftermath of this play out in the fixed bottom industry, policy interventions will be key in bringing developers and governments together, to build the floating landscape, without being of detriment to other industries involved. These interventions need to provide support funding for all supply chain companies to grow and secure business opportunities, prevent a safety net from associated risk, but also put an onus on developers to form partnerships with local companies and support this growth amongst the industry.”

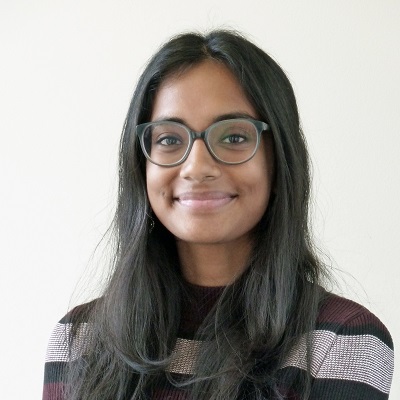

Sharanya Kumaramurthy

Energy Analyst at the Energy Industries Council (EIC)